With the dawn of Cod3x Lend and Cod3x USD, we’ve unlocked huge scaling capabilities. For the first time in history, we will have a totally unique value proposition, with a unique set of features and capabilities to match.

These new feature work together alongside DEX partners to create a new type of DeFi economy – one powered by volatility and arbitrage as opposed to yield, in service of everyday users as opposed to whales and funds.

cdxUSD

Our team developed cdxUSD to solve key scaling issues present in our current stablecoin infrastructure. cdxUSD allows lines of credit to be opened up to Facilitators, who can mint or burn cdxUSD based on strict limitations set by the protocol. This functionality is designed to ensure that every cdxUSD circulating is sufficiently backed.

By utilizing Facilitators, cdxUSD can enjoy the scaling benefits that centralized stablecoins have, while maintaining a sufficient level decentralization and code autonomy. We will be able to spread cdxUSD across all EVM networks easily, without requiring external user capital to initially collateralize the outgoing supply.

We can mint cdxUSD to anywhere users are already at.

Just how Tether issues under-collateralized loans to institutions, we can give out loans in cdxUSD to protocols – allowing them to reduce their cost of capital and generate revenue while giving users access to cdxUSD loans.

For example, we can mint $10mm of cdxUSD into an Aave market, where users can borrow directly to take advantage of market opportunities. We can obviously do the same via Cod3x Lend or our Chapter protocols.

We can effectively extend CDP functionality to other protocols and give them their own supply of cdxUSD to manage and for their users to use. We will also be introducing new liquidity primitives powered by cdxUSD which will give assets and protocols in DeFi unparalleled access to liquidity onchain.

Liquidity AMOs

Over the past nine months, we’ve seen demand for inflationary DeFi tokens effectively dry up. The writing has been on the wall for years now, but with the advent of memecoin launchpads, DeFi tokens have all but been pushed out of the crypto meta-game. It’s just too hard to deliver desirable R/R with micro-cap inflationary tokens.

A side effect of this is that reaching retail as a DeFi protocol is becoming nearly impossible, as whales and hedge funds are eager to eat up yield and dump indiscriminately, and nobody wants to take the other side of the trade.

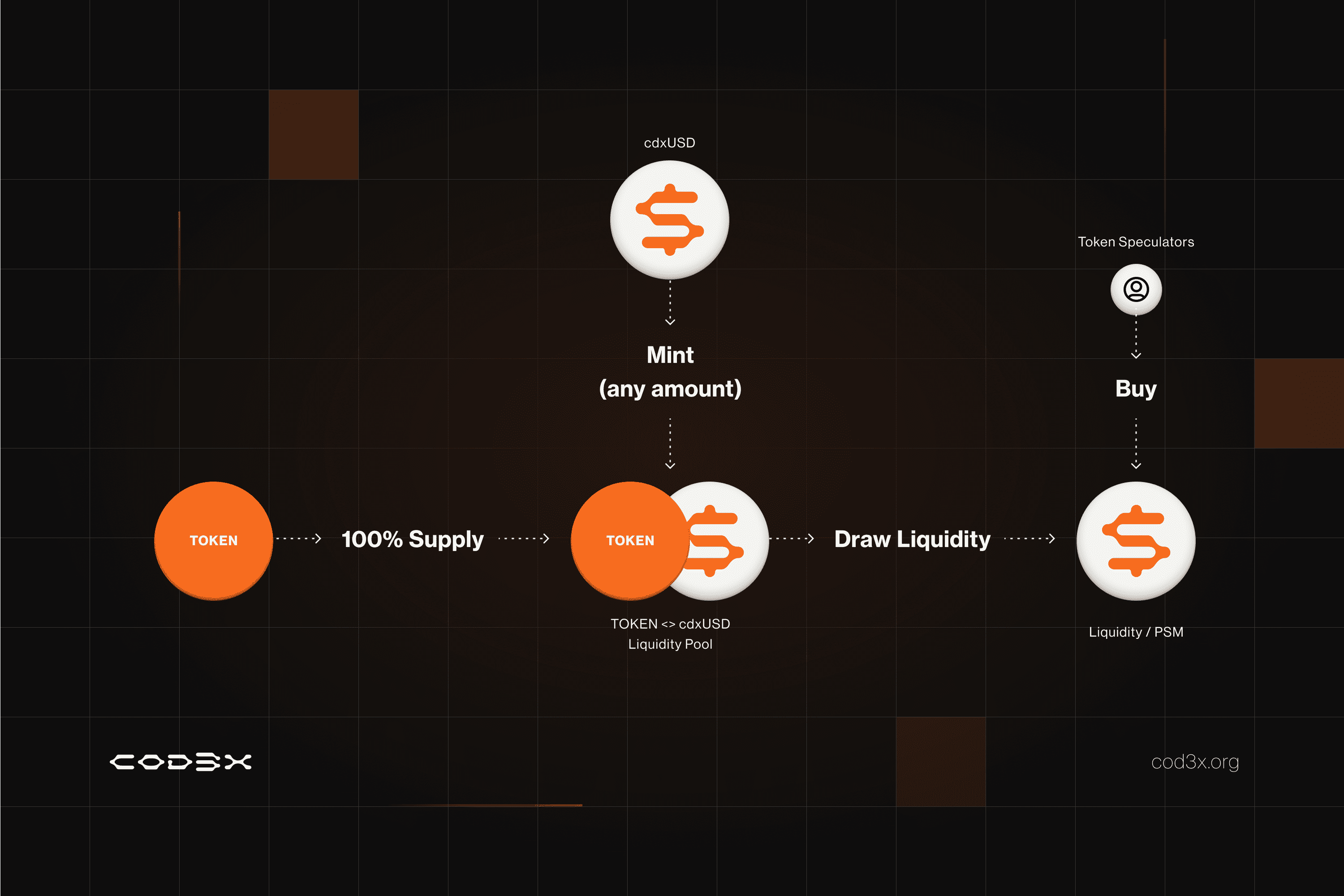

We seek to solve this crisis with the Liquidity AMO — a zero-inflation growth model for our DeFi protocols, using decentralized exchanges as Facilitators.

Liquidity AMOs are a new type of token distribution method designed by our team to solve for both liquidity and under-writability issues in tokens and scaling issues for decentralized stablecoins. Through these AMOs, our team can produce tokens with arbitrarily deep liquidity designed to work in tandem with our money market to improve R/R for traders.

These AMOs are quite simple — we mint 100% of a token’s supply to a liquidity pool paired with any amount of cdxUSD to match. Using the cdxUSD liquidity pool as a bottleneck to service demand for the token, our team is able to grow the supply of cdxUSD and thus its overall utility and functionality.

The deep starting liquidity for tokens launched using this methodology can also be underwritten more easily, as their liquidity backing is much deeper and more transparent.

We will be designing new apps and protocols around our liquidity AMO concept, and lean heavily on it for new protocol launches across DeFi.

Cod3x Lend

While every other lending platform is fighting to modularize and isolate risks, our team is figuring out how we can create systems through which risk can be fine-tuned without disrupting the deep liquidity and simple user experience we’ve fallen in love with via Aave.

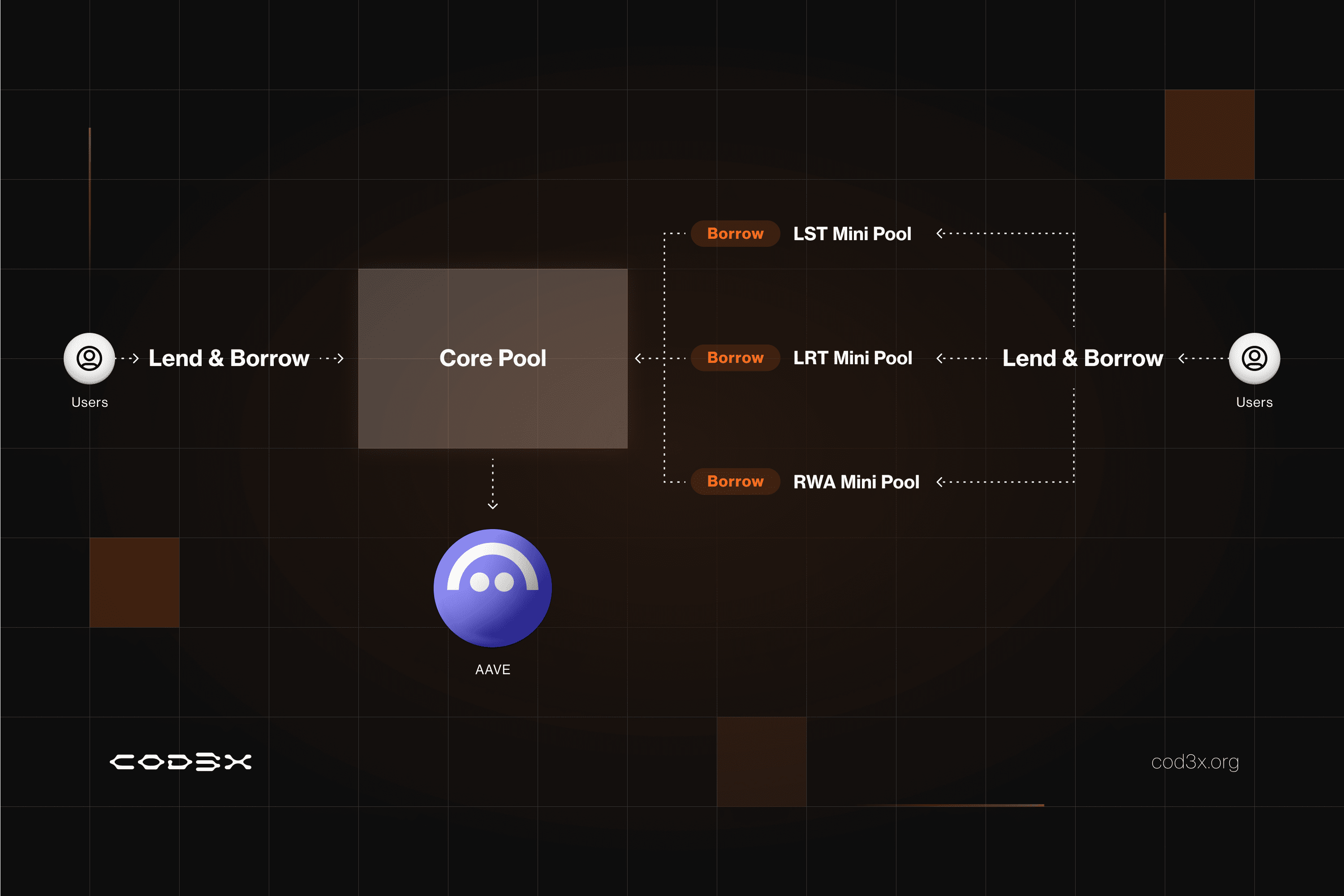

Compared to existing money markets, Cod3x Lend enhances functionality by introducing Mini Pools, Collateral Flow Controls, and collateral rehypothecation. Cod3x Lend aims to address the industry’s most pressing issues: liquidity fragmentation and risk management.

Mini Pools

Mini-Pools allow the protocol to accept unique and exotic collaterals, by setting debt ceilings and interest rates that reflect the risk profile of collateral. They effectively perform as isolated lending markets. While the core-pool accepts deposits of highly liquid, blue-chip collateral for supply, mini-pools are the mechanism by which global collateral supply is distributed in an isolated manner without fragmenting liquidity.

The most important feature of mini-pools is that they can borrow directly from the core pool, helping to isolate risks and opportunity costs while deepening overall liquidity of the system and also giving increased utility to debt thanks to its unique architecture.

Rehypothecation

Rehypothecation allows Cod3x Lend to re-inject liquidity into the broader ecosystem – further defragmenting liquidity while generating more yield for depositors. The rehypothecation approach focuses on minimal-risk strategies, achieving yield parity with the perceived risk-free lending rate (Aave) and making Cod3x Lend the most efficient and feature-rich lending protocol in DeFi.

Interest Rate Control System

Lend-borrow interest rates are governed by independent control systems that are tuned to maintain optimum utilization by constantly adapting to current utilization levels and autonomously adjusting interest rates. The effect is that interest rates for assets borrowed by core-pool borrowers (users and mini-pools), as well as mini-pool borrowers, adapt to market conditions and interest rate arbitrage automatically.

This approach corrects utilization over time, reduces illiquidity risks associated with high utilization, and ensures competitive interest rates in low utilization conditions.

What’s the Point?

We are creating novel systems to suit a new generation of DeFi users. Having built on Aave for three years now, we have developed a strong belief that their system will remain the best at serving the use-cases we see in crypto today.

Cod3x Lend and cdxUSD are designed to suit tomorrow’s use cases. Where we see a clear limit on the demand for over-collateralized borrowing, and we believe that the Cod3x DeFi ecosystem can offer a new world of risk, reward, and opportunity for users.

Our Research

The Cod3x tech stack is the result of years of research and development by our team: